The era of digital marketing can be marked as an advent milestone in the history of marketing. The technological advancements of the digital sphere have not only made many tasks easy, but it has also inducted several platforms that have extended innovative technology to realms of marketing arena in today’s world. The proof is solutions and services that were unimaginable before or just about a decade ago have manifested in our lives now as reality, as that not virtual at all. Content marketing and Fintech Company are among those miracles of digicoms.

Today’s marketing strategies are considered incomplete without a content strategy. 45% of the customers abandon the content if it’s not presented well on their device. That’s the reason 86% of B2B companies are using content marketing, including Fintech companies. Moreover, positive trends are not showing any sign of stopping. Before starting to analyze content marketing approaches, let’s talk about the basics of Fintech Company for better understanding.

What is Fintech?

Fintech, aka Financial Technology, is the new innovative industry that has evolved as an advanced mode of financial services and solution delivery. Unlike conventional economic methods, Fintech operates via technology as a digital product of technology. Fintech is derived with the use of smartphones and digital devices for banking, investing and trading in capital markets with the use of the digital mode of cryptocurrency.

As digital is the future of innovations, Fintech is the future of banking. Acknowledging and realizing the potential of this immense technology, established financial institutions, stakeholders and traditional players are already embracing the induction of Fintech for capital management. Alternatively, a large segment of those investors using Fintech has established a fair, competitive edge against conventional players. Hence, the need for Fintech Company has been realized well across the spectrum of the digital arena.

Advantages of Content Marketing For Fintech Companies

The days of outbound marketing has gone. Content marketing has changed the primary ways to approach customers. We live in the world driven by digital data, expended customer preferences, advanced search engine dynamics and reduced time of delivering solutions. Inbound marketing as content marketing is considered as the pioneer of the most effective marketing strategies for new businesses like Fintech Company startups. This is because they deal by focusing on improving customer’s trust and experience via personalization. Below are three significant advantages of content marketing for Fintech companies.

a) Trust Building:

Delivering informative and relevant quality content can help your customers to make an informed purchase decision, and that will eventually lead to letting them trust your company and services and stay loyal.

b) Cost-Effective:

The cost of an inbound lead is proven to be 60% less than the price of outbound lead. Moreover, the average cost per lead is reduced by 80% after six months, rolling out of strategy. Therefore content marketing is cost-effective, providing enormous benefits to Fintech Company startups.

c) More Viability:

Investors and customers prefer to understand your products and services in-depth before investing in capital. Hence, a great content strategy grows alongside your startup business. It nurtures the viability of your business, giving you long term prospects.

FintechContent Marketing Approaches For 2019

Change is a constant factor with the ever-evolving digital spectrum. That’s why your content marketing strategy should continuously be updated to accommodate the alterations in trends. Below are some of the best content marketing approaches to be considered by a Fintech company.

1. Responsive Website

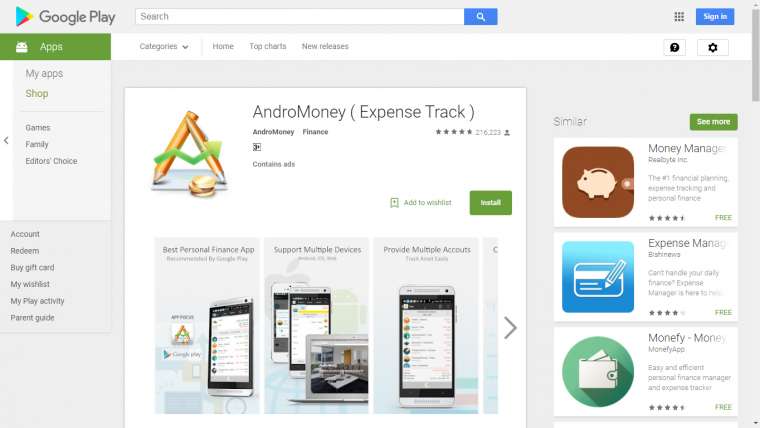

More than half of the online users use the internet on their mobile devices and smartphones rather than desktop or laptops. Internet users spend around five hours on mobile phones every day on average. Hence consider the mobile-first approach make your website responsive. Experts have estimated that more than 2 billion users will be using Fintech apps on their smartphones by 2020. The statistics suggest Fintech marketers should consider responsive user experience as an essential part of their content marketing strategy.

2. Embrace Social Media

With the emergence of being viral and being fashionable, social media has caught the heat among leads. It has become amazingly famous among marketers as well with the advent of content marketing. The social media user base is predicted to increase by ten folds soon. Hence, it is integral for Fintech companies to interact with their potential customers on social media platforms with a 24/7 approach.

3. Content is the King

Regardless of the platform used for marketing your content, it is the quality of your content that decides the efficiency and success of your marketing strategy. Generate quality content that is useful for your customer by enhancing their knowledge. Try to include some valuable insights and tools to manage finances for your customers. There are multiple tools available online that help you to polish and create high-quality content. The tools include;

Moreover, studies suggest that only 35% of a marketer have a smart insight of creating useful content. Hence, the above list of tools will be helpful to build an educative content, which is critical in determining the effectiveness of your content marketing strategy.

4. FocusBranding

It is the first step of every marketing strategy to be specific about being focused on promoting the brand at an early stage. It will help you to create a transparent distinction between your organization and your customer. Convey your purpose of a brand in a clear and consistent message to establish recognition of your brand among clients. After all, clients prefer to invest in unique and reliable companies. Therefore, branding is an active component of content marketing for Fintech companies.

5. Customer Engagement

Engaging your customer 24/7 is an ideal way to be a part of their daily lives. Make sure you do that either on social media, emails or even on phone calls. Smartly engaging a customer is the key to yield fantastic results. Research reveals that 70% of customers prefer to get information about a product, service or a company via articles instead of ads. Also, email marketing base holds a decent amount of prospect, and they are more likely to open personalized emails form a Fintech company rather than other niches.

6. Micro-Influencers

An influencer is considered as a micro-influencer if he/she has less than 10,000 followers on social media. They may not be very popular, but they keep a good fan base and have a high degree of influence over them. They can be beneficial for Fintech startups. They may not be cost-effective to hire; however, more credible to the audiences. Hence, credibility is a valuable factor for trust-building, especially where the money is involved.

7. Video Marketing

The statistic shows that brand awareness through video marketing can be increased by 60%. The reason is, videos have an instant appealing advantage over other communicating mediums.

They even grab laziest audiences. Videos are informative and entertaining at the same time. Hence, for a Fintech company thriving to grow big and aspiring to expand a business, including video content marketing in their strategy is a necessity.

Conclusion

Fintech industry is exponentially growing in its prominence and content marketing is an ideal way to increase loyal customer’s base. The only requirement is to do it with a framed strategy and utmost care. Since a high number of people are still suspicious of investing in digital banking, there is a need for extensive branding and its advantages to gain the trust of customers. The loyalty of customers can be achieved using the approaches mentioned above.

In a nutshell, Fintech has unlimited economic benefits on conventional financial schemes. Since there are not much-needed expenses for maintaining the capital inventory, investing in startups is a smart option. Also, Fintech companies need to market their products and establish them as reliable brands to thrive in the industry.